What is the Home Flipping Tax and how does it affect you?

As of January 1, 2025, British Columbia’s Residential Property (Short-Term Holding) Profit Tax Act, commonly known as the Home Flipping Tax, came into effect. The tax targets speculative real estate activity by taxing profits from the sale of residential properties held for less than 730 days. The tax applies not just to physical properties but also to the assignment of pre-sale contracts and includes individuals, corporations, trusts, and partnerships.

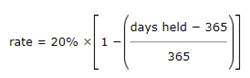

If you sell a property within 365 days of buying it, you will pay 20 percent tax on the profit. If you sell between 366 and 730 days, the tax rate gradually decreases to zero by day 730 determined by the following formula:

The profit is calculated as the sale price minus the purchase price and any improvement costs. A deduction of up to $20,000 is available if you lived in the home as your primary residence for at least 365 days. This deduction does not apply to pre-sale assignments.

There are exemptions. Some people and organizations do not need to pay or file, including charities, Indigenous nations, non-profits, and government organizations. Other exemptions, such as those for death, divorce, illness, job loss, or relocation, still require you to file a return but may reduce or eliminate the tax owed. Builders and developers will also be exempt if the property was held for construction or development.

Anyone who sells a property within two years must file a return within 90 days of the sale, even if they qualify for an exemption. Failure to file can lead to penalties.

TL;DR:

Who Does It Apply To?

- Individuals, corporations, trusts, and partnerships

- Sales of physical properties and assignment of pre-sale contracts

How Much Is the Tax?

- 20% tax on profit if you sell within 365 days of purchase

- Gradually decreases to 0% by day 730

- Profit = Sale price – Purchase price – Improvement costs

- Up to $20,000 deduction if the home was your primary residence for at least 365 days (does not apply to pre-sale assignments)

Are There Exemptions?

Yes, but you may still need to file:

- Full exemptions (no tax, no filing): Charities, Indigenous nations, non-profits, government organizations

- File required, possible reduction/elimination of tax: Death, divorce, illness, job loss, relocation

- Builders/developers are exempt if the property was held for construction or development

Filing Requirements

- If you sell within two years, you must file a return within 90 days of the sale, even if exempt.

- Failure to file can result in penalties.

If you are selling or assigning property in 2025 or later, you should seek a professional tax advisor or contact us for legal advice to understand the consequences and requirements of such transactions.